miércoles, 31 de octubre de 2012

Signals IMF leads global push for euro zone to boost firewall

Signals IMF leads global push for euro zone to boost firewall The head of the International Monetary Fund (IMF) Christine Lagarde attends a session at the World Economic Forum (WEF) in Davos, January 28, 2012. REUTERS/Christian Hartmann The head of the International Monetary Fund (IMF) Christine Lagarde attends a session at the World Economic Forum (WEF) in Davos, January 28, 2012. REUTERS/Christian Hartmann By Paul Carrel and Emma Thomasson DAVOS, Switzerland (Reuters) - International Monetary Fund chief Christine Lagarde led a global push on Saturday for the euro zone to boost its financial firewall, saying 'if it is big enough it will not get used.' Lagarde, supported by the British finance minister, George Osborne, said the IMF could boost its support for the euro zone but pressed its leaders to act first. Some attendees at the Davos Forum still doubted the viability of the currency union. Countries beyond the 17-country bloc want to see its members stump up more money before they commit additional resources to the IMF, which this month requested an additional 500 billion euros ($650 billion) in funding. 'Now is the time - there has been a lot of pressure building in order to see a solution come about,' Lagarde told a Forum panel discussion on the economic outlook from which euro zone leaders - most notably Germany - were conspicuously absent. 'It is critical that the euro zone members develop a clear, simple firewall that can operate both to limit the contagion and to provide this sort of act of trust in the euro zone, so that the financing needs of that zone can actually be met,' she said. Lagarde's comments rounded out a crescendo of calls at the Davos Forum for the euro zone to boost its financial defenses. The annual five-day conference began with German Chancellor Angela Merkel deflecting pressure to do so. In a carefully worded keynote address, Merkel suggested doubling or even tripling the size of the fund may convince markets for a time, but warned that if Germany made a promise that could not be kept, 'then Europe is really vulnerable.' On Friday, U.S. Treasury Secretary Timothy Geithner pressed Europe to make a 'bigger commitment' to boosting its firewall. Two bankers who attended meetings with Geithner at the Forum said on Friday the United States was looking for the euro zone to roughly double the size of its firewall to 1.5 trillion euros. There was no immediate comment from the U.S. Treasury. Osborne said the currency bloc must beef up its firewall before other countries increase their funding to the IMF. 'I think the euro zone leaders understand that,' said Osborne, the only European minister on Saturday's panel discussion on the global economic outlook in 2012. 'There are not going to be further contributions from G20 countries, Britain included, unless we see the color of their money,' he added, calling for the euro zone 'to provide a significant increase in available resources.' MORE OPTIMISM...FOR SOME Japanese Economics Minister Motohisa Furukawa echoed Osborne's comments, saying: 'Without the firm action of Europe, I don't think the developing countries like China or others are willing to pay more money for the IMF.' On condition that the euro zone boosts its own defenses, he said Japan and other countries were willing to additional support via the IMF. Lagarde said, however, that if the international lender's resources were boosted sufficiently, this would raise confidence to such a degree that they would not be needed. 'If it is big enough, it will not get used. And the same applies to the euro firewall for that matter,' she added. Japanese Prime Minister Yoshihiko Noda, speaking to the Forum by video link from Tokyo, said Japan was working with South Korea and India to reduce the risk of the euro zone crisis spreading to Asia. 'Japan stands ready to support the euro zone as much as possible,' he added. Mexico's central bank chief, Agustin Carstens, said on Friday he believed a consensus was building on boosting the IMF's resources to help European countries and others that might need aid from the global lender. There has been a palpable sense of hope at the Davos Forum that the euro zone is pulling back from the brink of catastrophe, though business leaders are equally worried that Europe's woes will hold back a global recovery. Osborne saw some signs of optimism. 'People have commented on the mood of this conference being quite somber but having been here for a couple of days people have also pointed out that actually people are slightly more optimistic at the end of the week than the beginning,' he said. However, Davos 2011 also ended on upbeat note about the euro zone and a feeling that worst of the crisis was over - only for the situation to deteriorate and financial markets to turn their fire on Italy, the bloc's third biggest economy. 'The euro zone is a slow-motion train wreck,' said economist Nouriel Roubini, made famous by predictions of the 2008-09 global banking crisis. He expected Greece, and possibly Portugal, to exit the bloc within the next 12 months and believed there is a 50 percent chance of the bloc breaking up completely in the next 3-5 years. Hong Kong's Chief Executive, Donald Tsang, said no matter how strong the euro zone's firewall is, the market will look at the nature of the economies it is protecting. 'If it is protecting insolvent economies...no matter how strong the firewall is, it won't survive,' he said. (Additional reporting by Ben Hirschler; Editing by Jon Boyle)

Forex Comments from G20 finance chiefs meeting in Mexico

Forex Comments from G20 finance chiefs meeting in Mexico MEXICO CITY (Reuters) - Following are comments from policymakers attending the meeting of Group of 20 finance ministers and central bankers in Mexico City on Saturday. U.S. TREASURY SECRETARY TIMOTHY GEITHNER 'I think it's important to give Europe's leaders credit for what they have accomplished ... and put in place in terms of the architecture of a credible response in the last four months.' 'They have had a big impact in reducing the downside risks to growth ... though it's important not to rest on that progress.' 'I hope that we're going to see, and I expect we will see, continued efforts by the Europeans ... to put in place a stronger, more credible firewall.' CANADIAN FINANCE MINISTER JIM FLAHERTY 'I do want to encourage Germany to take that leadership role very seriously and come up with an overall euro zone plan.' 'I think that what I'd like to see in the communique is language that indicates that the real question is, when will we see the euro zone plan. And that discussions about other countries through the IMF supporting the euro zone plan should await the answer to the first question.' 'I don't think we're ever going to be able from the outside to impose a deadline on the euro zone. That's up to them.' GERMAN FINANCE MINISTER WOLFGANG SCHAEUBLE 'It does not make any economic sense to follow the calls for proposals which would be mutualizing the interest risk in the euro zone, nor in pumping money into rescue funds, nor in starting up the ECB printing press.' 'I am worried the overriding problems ... have not been tackled sufficiently. We have to be more daring when it comes to these large and fundamental challenges.' 'You know that Greece is a special and unique case...The main difficulty is a serious lack of competitiveness.' JAPANESE FINANCE MINISTER JUN AZUMI 'I'd like to see how Europe will make concrete efforts and then discuss how we can contribute.' 'I said that I expect debate on strengthening of the IMF lending capacity will progress on condition that the problem of Europe's debt crisis is put to an end by the G20 meeting in Washington in April.' 'The present firewall involves strengthening of EFSF and increase of upper cap on ESM. But I said (at G20) that they should be further strengthened.' 'The economy is somewhat picking up in the world as a whole, including Japan, and (we) want to put an end to the Europe crisis in the early spring and to accelerate the global economic growth.' BRAZILIAN FINANCE MINISTER GUIDO MANTEGA 'Emerging countries will only help under two conditions; first that they strengthen their firewall and second for the IMF (quota) reform be implemented.' 'I see most countries sharing a similar opinion that the Europeans have to strengthen their firewall.' JAY COLLINS, SENIOR CITIGROUP EXECUTIVE 'The lack of a firewall decision coming out of Europe takes a toll, speed matters.' 'Speed and urgency is critical.' BANK OF JAPAN GOVERNOR MASAAKI SHIRAKAWA 'Heightening geographical risks and some bright movements in advanced economies after the New Year are factors behind the underlying crude oil price hikes. Of course, monetary easing has been continuing but I don't see it as a major factor for driving up crude oil prices. Generally speaking, we'll closely watch effects and side-effects of monetary easing.' MARK CARNEY, BANK OF CANADA GOVERNOR AND CHAIRMAN OF THE FINANCIAL STABILITY BOARD 'We are cursed with living in extraordinary times. There are two critical challenges that are really facing policymakers at the moment. Restoring growth and stability in Europe. There's been quite appropriately tremendous attention paid to that. But at the same time, just doing that will not be enough.' 'We need to rebuild strong, sustainable, balanced growth in the global economy.' 'One of the issues in these G20 meetings has been that the issue of the moment has often, not surprisingly, crowded out this fundamental medium-term issue.' 'For emerging markets, the weak growth prospects and large accommodative monetary policies in the G3 (major advanced economies) tends to push capital flow towards them, exacerbating concerns about sudden stops and potentially causing a reaction in terms of capital controls.' 'Some emerging markets are reluctant to abandon exchange rate strategies which have served them so well in the past, and so there's a vicious circle here.' BANK OF ITALY GOVERNOR IGNAZIO VISCO 'During the G20 meeting we will discuss the outlook for the global economy and we will probably talk about the developments on the oil markets. Tensions are growing.' 'We have to be vigilant regarding oil.' 'At the moment we don't see the need for a new LTRO by the ECB, but we will have to see the whole effects of the second one (on February 29) before taking a decision.' 'Italy has made remarkable progress on the budget side, now it has to work on growth, even Europe should insist on growth.' OECD SECRETARY-GENERAL ANGEL GURRIA 'The Greek bailout was not a deal, it was an ordeal ... the problem was it came too late.' 'I don't know if Greece's debt target of 120 percent of GDP will be enough -- that will depend on whether Greece delivers on its policies.' 'We have run out of monetary policy room ... we have run out of fiscal room in most countries, some have a little fiscal room now.' 'The ECB's LTRO (long term refinancing operation) is no substitute for a European firewall.' 'It's already six months to a year late... We need a massive European firewall now.' (Compiled by Kieran Murray)

lunes, 29 de octubre de 2012

Earn Comments from G20 finance chiefs meeting in Mexico

Earn Comments from G20 finance chiefs meeting in Mexico MEXICO CITY (Reuters) - Following are comments from policymakers attending the meeting of Group of 20 finance ministers and central bankers in Mexico City on Saturday. U.S. TREASURY SECRETARY TIMOTHY GEITHNER 'I think it's important to give Europe's leaders credit for what they have accomplished ... and put in place in terms of the architecture of a credible response in the last four months.' 'They have had a big impact in reducing the downside risks to growth ... though it's important not to rest on that progress.' 'I hope that we're going to see, and I expect we will see, continued efforts by the Europeans ... to put in place a stronger, more credible firewall.' CANADIAN FINANCE MINISTER JIM FLAHERTY 'I do want to encourage Germany to take that leadership role very seriously and come up with an overall euro zone plan.' 'I think that what I'd like to see in the communique is language that indicates that the real question is, when will we see the euro zone plan. And that discussions about other countries through the IMF supporting the euro zone plan should await the answer to the first question.' 'I don't think we're ever going to be able from the outside to impose a deadline on the euro zone. That's up to them.' GERMAN FINANCE MINISTER WOLFGANG SCHAEUBLE 'It does not make any economic sense to follow the calls for proposals which would be mutualizing the interest risk in the euro zone, nor in pumping money into rescue funds, nor in starting up the ECB printing press.' 'I am worried the overriding problems ... have not been tackled sufficiently. We have to be more daring when it comes to these large and fundamental challenges.' 'You know that Greece is a special and unique case...The main difficulty is a serious lack of competitiveness.' JAPANESE FINANCE MINISTER JUN AZUMI 'I'd like to see how Europe will make concrete efforts and then discuss how we can contribute.' 'I said that I expect debate on strengthening of the IMF lending capacity will progress on condition that the problem of Europe's debt crisis is put to an end by the G20 meeting in Washington in April.' 'The present firewall involves strengthening of EFSF and increase of upper cap on ESM. But I said (at G20) that they should be further strengthened.' 'The economy is somewhat picking up in the world as a whole, including Japan, and (we) want to put an end to the Europe crisis in the early spring and to accelerate the global economic growth.' BRAZILIAN FINANCE MINISTER GUIDO MANTEGA 'Emerging countries will only help under two conditions; first that they strengthen their firewall and second for the IMF (quota) reform be implemented.' 'I see most countries sharing a similar opinion that the Europeans have to strengthen their firewall.' JAY COLLINS, SENIOR CITIGROUP EXECUTIVE 'The lack of a firewall decision coming out of Europe takes a toll, speed matters.' 'Speed and urgency is critical.' BANK OF JAPAN GOVERNOR MASAAKI SHIRAKAWA 'Heightening geographical risks and some bright movements in advanced economies after the New Year are factors behind the underlying crude oil price hikes. Of course, monetary easing has been continuing but I don't see it as a major factor for driving up crude oil prices. Generally speaking, we'll closely watch effects and side-effects of monetary easing.' MARK CARNEY, BANK OF CANADA GOVERNOR AND CHAIRMAN OF THE FINANCIAL STABILITY BOARD 'We are cursed with living in extraordinary times. There are two critical challenges that are really facing policymakers at the moment. Restoring growth and stability in Europe. There's been quite appropriately tremendous attention paid to that. But at the same time, just doing that will not be enough.' 'We need to rebuild strong, sustainable, balanced growth in the global economy.' 'One of the issues in these G20 meetings has been that the issue of the moment has often, not surprisingly, crowded out this fundamental medium-term issue.' 'For emerging markets, the weak growth prospects and large accommodative monetary policies in the G3 (major advanced economies) tends to push capital flow towards them, exacerbating concerns about sudden stops and potentially causing a reaction in terms of capital controls.' 'Some emerging markets are reluctant to abandon exchange rate strategies which have served them so well in the past, and so there's a vicious circle here.' BANK OF ITALY GOVERNOR IGNAZIO VISCO 'During the G20 meeting we will discuss the outlook for the global economy and we will probably talk about the developments on the oil markets. Tensions are growing.' 'We have to be vigilant regarding oil.' 'At the moment we don't see the need for a new LTRO by the ECB, but we will have to see the whole effects of the second one (on February 29) before taking a decision.' 'Italy has made remarkable progress on the budget side, now it has to work on growth, even Europe should insist on growth.' OECD SECRETARY-GENERAL ANGEL GURRIA 'The Greek bailout was not a deal, it was an ordeal ... the problem was it came too late.' 'I don't know if Greece's debt target of 120 percent of GDP will be enough -- that will depend on whether Greece delivers on its policies.' 'We have run out of monetary policy room ... we have run out of fiscal room in most countries, some have a little fiscal room now.' 'The ECB's LTRO (long term refinancing operation) is no substitute for a European firewall.' 'It's already six months to a year late... We need a massive European firewall now.' (Compiled by Kieran Murray)

sábado, 27 de octubre de 2012

miércoles, 24 de octubre de 2012

Signals How the Election and Economy Will Impact Your Portfolio

Signals There's plenty of data to help handicap the market during Presidential election years and it happens to be siding on the investor's team when it comes to an incumbent up for re-election. Jeffrey Hirsch, the editor-in-chief of the Stock Trader's Almanac crunched those numbers and says since the beginning of the Dow in 1896, an incumbent president has run for re-election 19 times; 14 of those were up years for the DJIA. 'Just the fact that there's somebody in office running again is a good sign for the year — 9% on average — what happens is early on if it's a real popular president doing well the market stays up,' Hirsch says. 'If you've got someone really unpopular come election time and they get ousted, there's a rally in November/December, sort of a 'ding dong the witch is dead' type of rally.' As for those five times when the trend didn't hold, only two were particularly bad years: 1932 which saw the removal of Herbert Hoover and 1940 when World War II was already raging in Europe. It's not just the election that offers insight into the next eleven and a half months. Hirsch notes that the end of the 'deflation fear period' should be a good sign in the short-term, but further down the road it 'puts a cap on things.' He cites a housing market that picked up and then flat-lined, consumer confidence that has come up (but not enough), and improving unemployment numbers as a sign that the economy is on the mend. He says it is 'good enough to keep us from having a really bad year' but not good enough to see a breakout to new highs. Specifically Hirsch is looking at 5-10% growth year-over-year, with a Dow target somewhere between 13,000 and 13,500. Still, he cautions the economy, the election, Europe and any number of other international factors could lead to amended forecasts in either direction. Then there's the market volatility — the same that plagued investors throughout 2011. Hirsch says it's here to stay again in 2012. 'Come spring you start looking for a technical trigger,' says Hirsch. 'Get a little bit more on the sidelines, take some profits, cover yourself...and then get back in for the year-end rally...Trade the seasons, trade the range and you should do okay.' How are you playing the election year, the economy and the volatility? Tell us on our Facebook page or in the comments below. Related Quotes: ^DJI 12,428.26 -21.19 -0.17% ^IXIC 2,715.99 +5.23 +0.19% ^GSPC 1,291.70 -0.78 -0.06%

martes, 23 de octubre de 2012

Signals Choppy action continues

Signals

he market continues to go up in choppy manner. It has so far held its gain. There are very few signs of aggressive buying at this stage.

Market has had tough time sustaining multi week rallies. We will see if this time it is different. This is the kind of environment where you have to focus on small moves while protecting capital.

Market has had tough time sustaining multi week rallies. We will see if this time it is different. This is the kind of environment where you have to focus on small moves while protecting capital.

lunes, 22 de octubre de 2012

Earn Multi year range breakout

Earn

The market had a breakout last week. The breakout was preceded by 13 days of base. The breakout also coincides with market taking out multi year high.

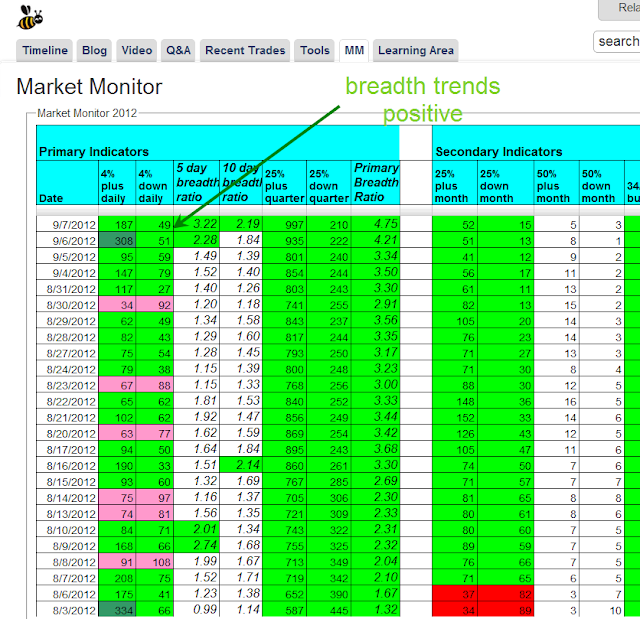

Below the surface quality breakouts on momentum stocks are increasing. The breadth trends are positive for last couple of weeks.

The market had a breakout last week. The breakout was preceded by 13 days of base. The breakout also coincides with market taking out multi year high.

Below the surface quality breakouts on momentum stocks are increasing. The breadth trends are positive for last couple of weeks.

domingo, 21 de octubre de 2012

Forex Multi year range breakout

Forex

The market had a breakout last week. The breakout was preceded by 13 days of base. The breakout also coincides with market taking out multi year high.

Below the surface quality breakouts on momentum stocks are increasing. The breadth trends are positive for last couple of weeks.

The market had a breakout last week. The breakout was preceded by 13 days of base. The breakout also coincides with market taking out multi year high.

Below the surface quality breakouts on momentum stocks are increasing. The breadth trends are positive for last couple of weeks.

jueves, 18 de octubre de 2012

Earn Why You Shouldn't Manage Your Friends' Money

Earn Why You Shouldn't Manage Your Friends' Money So you put away some nice returns this year - not too shabby. While you can't be blamed for bragging about good performance, it's not uncommon for friends to want a part of the action. What would you do if a friend asked you to make investments on his or her behalf? In this article we'll show you the highs and lows of investing for others. Taking Advantage of Your Financial Knowledge It's no surprise that your pals might want you to manage a couple of bucks for them. If you're pulling down decent returns and talking about your investing strategies, you've now become the go-to guy (or girl). These days, money talks and people who understand the financial world are getting a lot of respect as young people realize there's more to investing than they once thought. If you have financial knowledge, people who know you might view you as a very valuable commodity - a free money manager. All too often, the person asking you to invest his or her money is the person who knows a little something about investing - just enough to get into trouble. If you're nailing double-digit returns this year, why couldn't you repeat the performance year after year, right? The Problems with Investing for Others You may think that investing for someone else is just a way of helping out a friend, but the thing is, when you start investing for other people, particularly your friends, you enter a world of complications that you might not have foreseen when you started out. Unrealistic Expectations That friend of yours, the one who thinks that your 35% returns this year are going to happen next year as well, might be in for a nasty surprise when your picks make next to nothing. When you invest for friends, you have to deal with unrealistic expectations that can really put a damper on a relationship. If your friends wants you to invest for them, they likely don't understand all of the risks involved with investing, including not quite meeting the investment goals that they may have been projecting. Losing a Friend's Money Not meeting a friend's investing expectations could jeopardize your friendship, but falling short of your friend's projected returns could be a best-case scenario. When things go wrong, making some money is a lot better than losing money, which isn't an abstract concept for anyone who invests actively. When you bring money into a relationship, things can get uncomfortable pretty fast, especially when that money is hemorrhaging out of an investment account. Do you tell the friend to suck it up? Do you repay the person out of your pocket? Do you try to make up the difference with new picks? Really, there probably isn't a good way to deal with losing a friend's money and you should consider this risk before you agree to invest for anyone. Legal Matters Managing a friend's money is a sticky business and if you go through with it you may be breaking the law. Investment professionals must be registered with the Securities and Exchange Commission or have a federal license. They are heavily regulated by the government and by trade organizations like the National Association of Securities Dealers, for the protection of consumers. If you invest for a friend for compensation, you could be breaking laws that are in place to protect investors from people who aren't qualified to have discretionary control over others' accounts. Short End of the Stick Despite the drawbacks, investing for friends isn't always doomed to failure. With skill, smarts and a whole lot of luck, you might rake in the cash. If that's the case, you still have to consider whether or not your friend is taking advantage of you. Helping out a friend is nice, but when that help consists of making significant amounts of money for that person and getting little or nothing in return, you might be suffering from an off-balance relationship. What You Can Do for Friends Now that I've taken the wind out of your sails, and your friend's as well, there are things that you can do to help your friends' investments without burdening yourself with the substantial responsibility of investing someone else's money. One of the best ways to lend a hand is to help teach your friend about investing. Help Them Learn There are a lot of pitfalls out there for new investors. If you're lucky, you've been able to avoid quite a few of them or you learned how you should have gone about avoiding them. The benefit of your experience can be one heck of an asset to pass on to a friend and it won't cost either one of you personally or financially. Therefore, if you want to help your friends, work with them; show them how to analyze a financial statement, how to execute a trade online, how to look up business news, or how to find online resources. Investment Clubs Going farther still, there is a popular way to invest hands-on with friends without taking on the responsibility that an investment advisor would feel for a client - the investment club. The investment club consists of a group of people who vote to decide whether or not to buy or sell their group-owned investments. Investment clubs are great, because they allow a more personal approach with actual investments than just helping someone with investing concepts. These clubs will also give you a vested interest in performance of your friend's portfolio. If you're interested in starting an investment club, there are plenty of resources available, ranging from your broker to the internet. It's important to recognize that an investment club isn't just a couple of people who want to invest together - it's a formal (and legally defined) organization with members who have an equitable claim to their assets. This means you should look into the rules and laws that govern investment clubs where you live before joining or starting one yourself. The Bottom Line Investing for a friend usually isn't worth the amount of trouble it can cause. Money just isn't something you want to bring into a good friendship. In the end, by helping your friends invest on their own, you'll be doing them, and yourself, a much bigger favor.

martes, 16 de octubre de 2012

Signals GRU worth a bet

Signals

GRU: ELEMENTS MLCX Grains Index TR ETN had a high volume yesterday. Between mid June and to mid July it made 40% move in one month. So if the breakout works it has potential for big move.

lunes, 15 de octubre de 2012

Earn Citigroup cut investment bank bonuses by 30 percent: report

Earn Citigroup cut investment bank bonuses by 30 percent: report (Reuters) - Citigroup (NYSE:C - News) has cut bonuses for its investment banking division by about 30 percent on average, Bloomberg said, citing a person briefed on the matter. Some businesses within the securities and banking unit had bonuses reduced by as much as 70 percent, Bloomberg reported. Citigroup was not immediately available for comment. (Reporting by Abhiram Nandakumar in Bangalore; Editing by Steve Orlofsky)

Earn Retail sales: Shoppers pulled back at the holidays

Earn Retail sales: Shoppers pulled back at the holidays CNNMoney.comBy Chris Isidore | CNNMoney.com Consumers pulled back on their spending in December despite the holiday shopping season, according to a government report released Thursday. The Commerce Department report showed that overall retail sales rose only 0.1% compared to November -- falling short of forecasts of economists surveyed by Briefing.com, who were expecting a 0.4% rise. Excluding auto sales, which were relatively strong in the month, sales fell 0.2%; compared to forecasts of a 0.3% rise. Part of the reduced spending came from lower prices. Lower gasoline prices trimmed spending at gas stations by 1.6% compared to November. And spending at grocery stores also declined 0.2% in the same period amid reports of some lower food prices. Paul Dales, senior U.S. economist for Capital Economics, said it was somewhat positive that lower prices allowed non-discretionary spending to decline 0.6%, at the same time that discretionary spending rose 0.4%. 'It appears they're saving money when they go to fill up their cars, and spending it on something more enjoyable,' he said. But there were also declines in some retail categories that typically get a lift from holiday shoppers. The biggest was a 3.9% drop at electronic and appliance stores. Department store sales also fell 0.2%, leading to a 0.8% drop in general merchandise stores. Non-store retailers, typically online retailers, suffered a 0.4% drop. Mark Vitner, senior economist with Wells Fargo Securities, said his firm's measure of 'core' sales -- which excludes autos, gas stations and building materials -- posted the first monthly decline in a year. These excluded sectors are heavily influenced by volatile prices or by the business cycle. 'The decline here gets our attention,' he said. 'We do not think the consumer is completely going into hiding, but we do think that the pace of consumer spending growth is poised to slow.' Economists said that with other economic readings showing that stagnant wages were not keeping up with prices overall, and rising credit card balances, there's a limit in how much consumers will be able to spend -- even as a declining savings rate suggested that consumers were more willing to dip into savings. 'Households have realized that the savings only go so far,' said Dales. Disappointing December spending left overall sales up 6.5%, compared to 6% a year earlier which excludes auto sales. Bucking the trend were clothing retailers, which enjoyed a 0.7% rise in spending; and a 1.6% rise at building material and garden equipment retailers, which Dales said may have been helped by unusually mild weather. View this article on CNNMoney

domingo, 14 de octubre de 2012

Oil Stock likely to breakout

Oil

HSY, EW, DVA, TVL, AOL, and IPGP are currently setting up for a possible breakout. All these stocks have excellent momentum currently and are going sideways or pulling back and offer buy opportunity on high volume breakouts.

sábado, 13 de octubre de 2012

Signals Glass is still half full for flush American farmers

Signals Glass is still half full for flush American farmers WASHINGTON (Reuters) - Brian Roach scrawled a simple outlook for corn prices in a spiral notebook, with a line diving from the upper left hand corner to the lower right. Sitting in a hotel ballroom at the U.S. Department of Agriculture's annual Agricultural Outlook Forum last week, the commodity broker predicted increasing supplies and weakening demand would slow a boom in the farm economy that has fattened growers' wallets and pushed up food prices. 'Nothing is telling me to think any different right now,' said Roach, president of the Florida-based commodity business Roach Ag Marketing. For the first time in years at the conference that traditionally kicks off the year for America's agri-business sector, forecasters said the seemingly endless upward trajectory on everything from crop prices to farmer income was coming to an end. The price of corn, the big daddy of the major U.S. crops, could fall 20 percent this year and because of expanding production globally, the corn stockpile would double. It is a significant shift after corn prices reached a record high near $8 a bushel last summer on concerns about strong demand draining inventories. The surge in prices is expected to encourage an expansion in planting of crops this year. Farmers are becoming 'very pragmatic about the investments they're making in machinery, equipment and input costs' after spending freely following last autumn's profitable harvest, said Thomas Dorr, president of the U.S. Grains Council. Many built new storage bins and upgraded their tractors and combines. Moving forward, 'the mood is one of caution,' Dorr said. To be sure, farmers are flush with cash after farm income topped $100 billion for the first time in 2011 as the rural economy rebounded from the pothole of the global recession. Even if income slumps to $96.3 billion this year due to larger world and domestic supplies as predicted by the government, farmers and ranchers would be looking at their second-best year ever. Income would remain well above the 10-year average. 'Prospects for U.S. agriculture continue to be strong with record income in 2011 and a strong balance sheet,' said Joe Glauber, the USDA chief economist. Still, there was a sense of deja vu of 2008 at the conference that attracts some 2,000 attendees. That year, farmers enjoyed sky high prices for their crops but marching in lockstep, was the price of crude oil. The recent spike in fuel prices could again add pressure to the farm economy. Energy costs squeeze farmer margins because they depend heavily on tractors, combines, pesticides and fertilizers -- which track the price of fuel -- to get most out of their land. 'Energy costs to a farmer are obviously a serious concern,' said David Berg, president of the American Crystal Sugar Company, based in Moorhead, Minn. 'It's almost like a few years ago where everyone was in a state of panic.' He said sugar beet farmers in Minnesota and North Dakota are doing well but a double whammy of lower prices on the market for the commodity and higher energy prices would be hard to swallow for a number of growers. 'The price of sugar is high enough so that an increase in energy costs is a negative for them, but it's not going to put them under water,' Berg said. 'If the price of sugar goes down from where it is today, it will very likely put some of them under water.' Tyson Foods also is worried about rising fuel costs, with Chief Executive Donnie Smith warning the recent jump in gas prices could dent demand for beef by reducing disposable income of consumers. Beef prices have reached record levels due to a historic drought that reduced cattle herds in the southern Plains and high prices for corn that is fed to livestock. 'You're not moving as much volume of meat but you're paying more for it,' Smith told reporters at the conference. A drop in demand for meat could hurt livestock producers even as increased grain production would cut their feed costs. Farmers are expected to go all out to get their seeds in the ground this spring, especially with the mild winter that is now coming to a close. The USDA estimates they will plant 94 million acres (38 million hectares) of corn, about 2 million acres more than last year and the largest area since 1944. Still, Jon Caspers, a producer of about 8,000 hogs a year in Iowa, is not breathing a sigh of relief due to high gasoline prices and lingering uncertainty about demand. He's also unsure farmers will plant as much corn as expected. Last year, heavy spring rains dashed their plans to plant from fence post to fence post. 'A lot of producers are waiting to see if it really happens,' he said. (Additional reporting by Charles Abbott; Writing by Russ Blinch; Editing by Marguerita Choy)

Suscribirse a:

Entradas (Atom)